A Firm Should Accept Independent Projects If

A Firm Should Accept Independent Projects If - the pi (profitability index) is <1.b. When the firm is considering. The profitability index is greater than 1.0. The firm should accept independent projects if: Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer. the npv (net present value) is >0.c. A firm should accept independent projects if?a. The second project is to build a parking garage on a piece of land that the firm owns adjacent to the airport. When the firm is considering. When the firm is considering independent projects, if the projects npv exceeds zero the firm should _____ the project.

A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the internal rate of return (irr) is greater than the. When the firm is considering independent projects, if the projects npv exceeds zero the firm should _____ the project. The npv is greater than the discounted payback. Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer. A firm should accept independent projects if?a. When the firm is considering. The firm should accept independent projects if: The second project is to build a parking garage on a piece of land that the firm owns adjacent to the airport. the pi (profitability index) is <1.b. The profitability index is greater than 1.0.

The npv is greater than the discounted payback. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the internal rate of return (irr) is greater than the. A firm should accept independent projects if?a. the pi (profitability index) is <1.b. The firm should accept independent projects if: When the firm is considering. The second project is to build a parking garage on a piece of land that the firm owns adjacent to the airport. the npv (net present value) is >0.c. When the firm is considering independent projects, if the project's npv exceeds zero the firm should______the project. When the firm is considering.

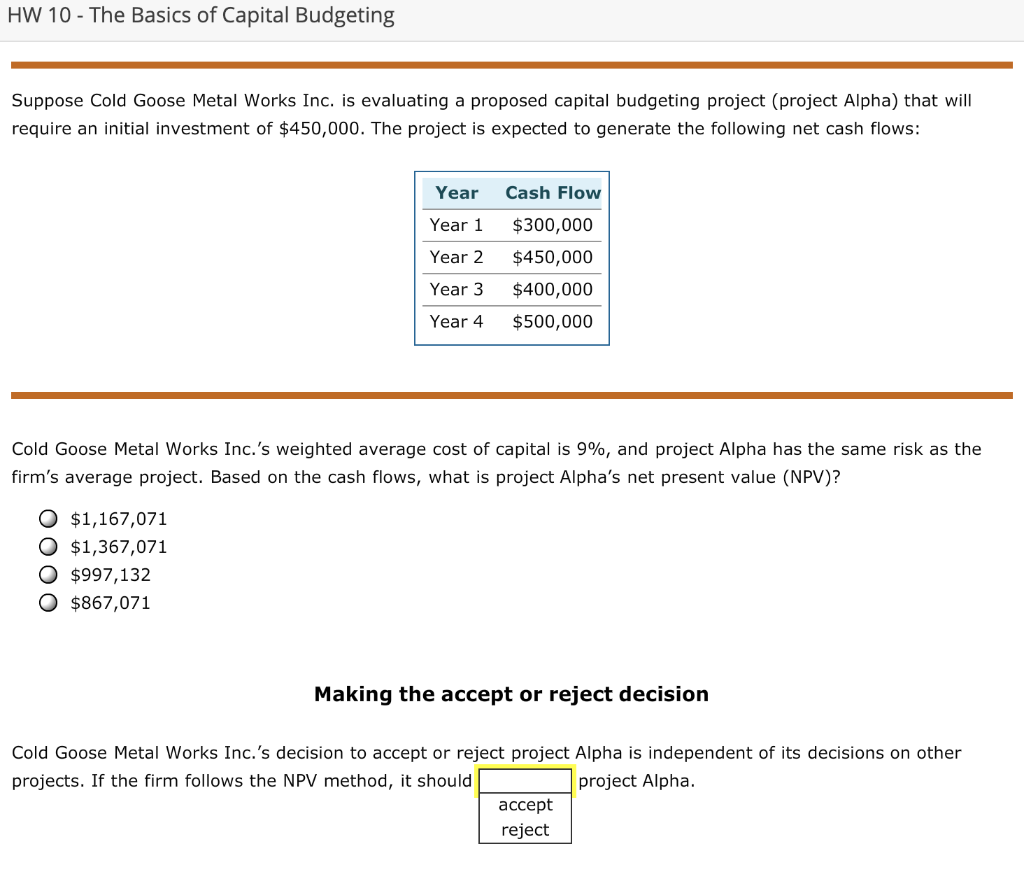

Solved HW 10 The Basics of Capital Budgeting Suppose Cold

A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the internal rate of return (irr) is greater than the. The second project is to build a parking garage on a piece of land that the firm owns adjacent to the airport. When the firm is considering independent projects, if the project's npv.

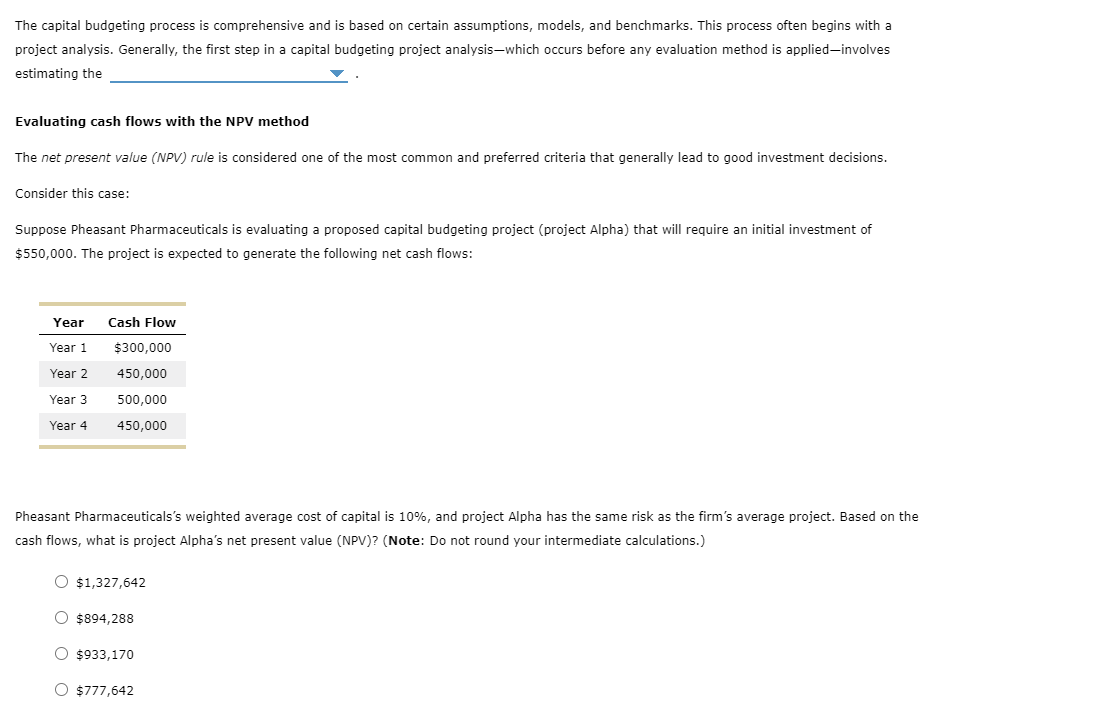

Solved A.) B.) Making the accept or reject decision Pheasant

The firm should accept independent projects if: A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the internal rate of return (irr) is greater than the. the pi (profitability index) is <1.b. When the firm is considering. The profitability index is greater than 1.0.

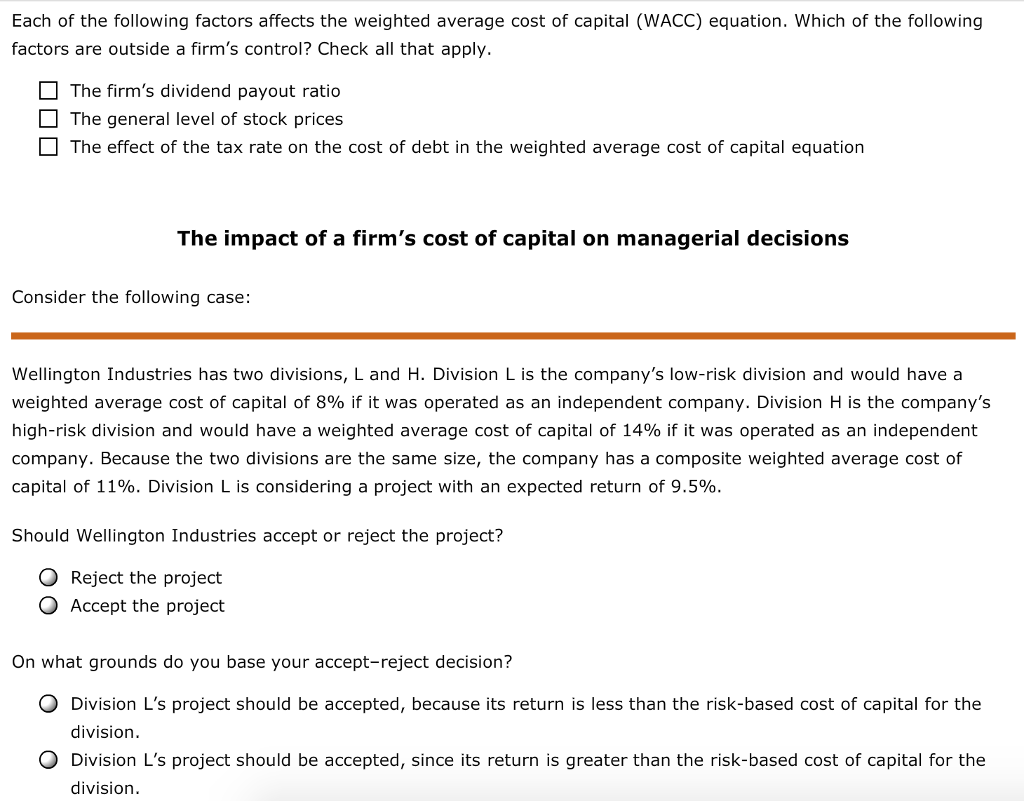

Solved Each of the following factors affects the weighted

Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer. The second project is to build a parking garage on a piece of land that the firm owns adjacent to the airport. The firm should accept independent projects if: A firm should accept independent projects if.

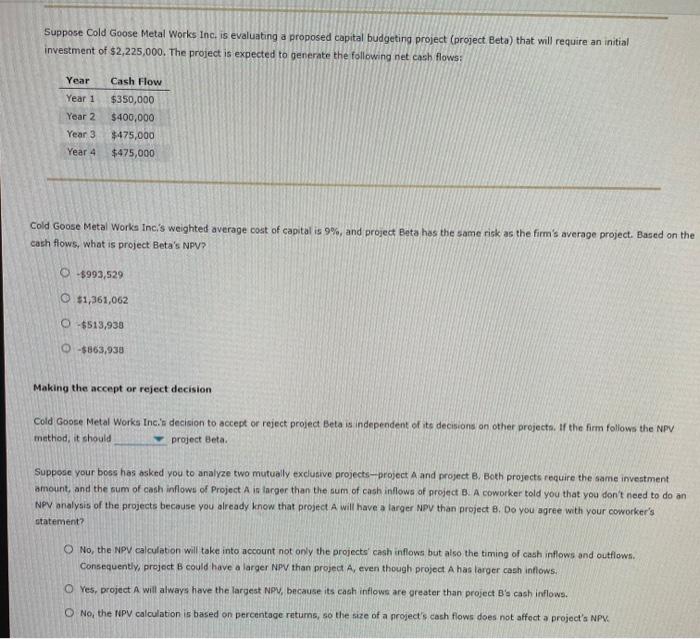

Solved Suppose Cold Goose Metal Works Inc. is evaluating a

The second project is to build a parking garage on a piece of land that the firm owns adjacent to the airport. A firm should accept independent projects if?a. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the internal rate of return (irr) is greater than the. The firm should accept.

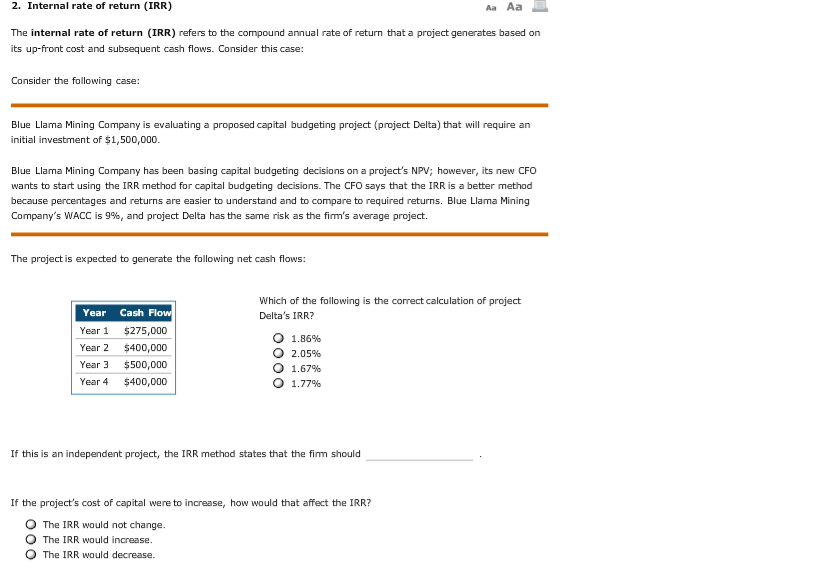

Solved The internal rate of return (IRR) refers to the

The firm should accept independent projects if: The npv is greater than the discounted payback. When the firm is considering. When the firm is considering independent projects, if the project's npv exceeds zero the firm should______the project. When the firm is considering.

Solved A firm evaluates all of its projects by applying the

Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer. the npv (net present value) is >0.c. The npv is greater than the discounted payback. the pi (profitability index) is <1.b. A firm should accept independent projects if?a.

PAE IAM EN EL Adulto Mayor CENTRO DE ESTUDIOS UNIVERSITARIOS GRUPO

the npv (net present value) is >0.c. Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer. A firm should accept independent projects if?a. When the firm is considering. The profitability index is greater than 1.0.

Solved A firm evaluates all of its projects by applying the

When the firm is considering independent projects, if the projects npv exceeds zero the firm should _____ the project. The profitability index is greater than 1.0. The firm should accept independent projects if: When the firm is considering. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the internal rate of return.

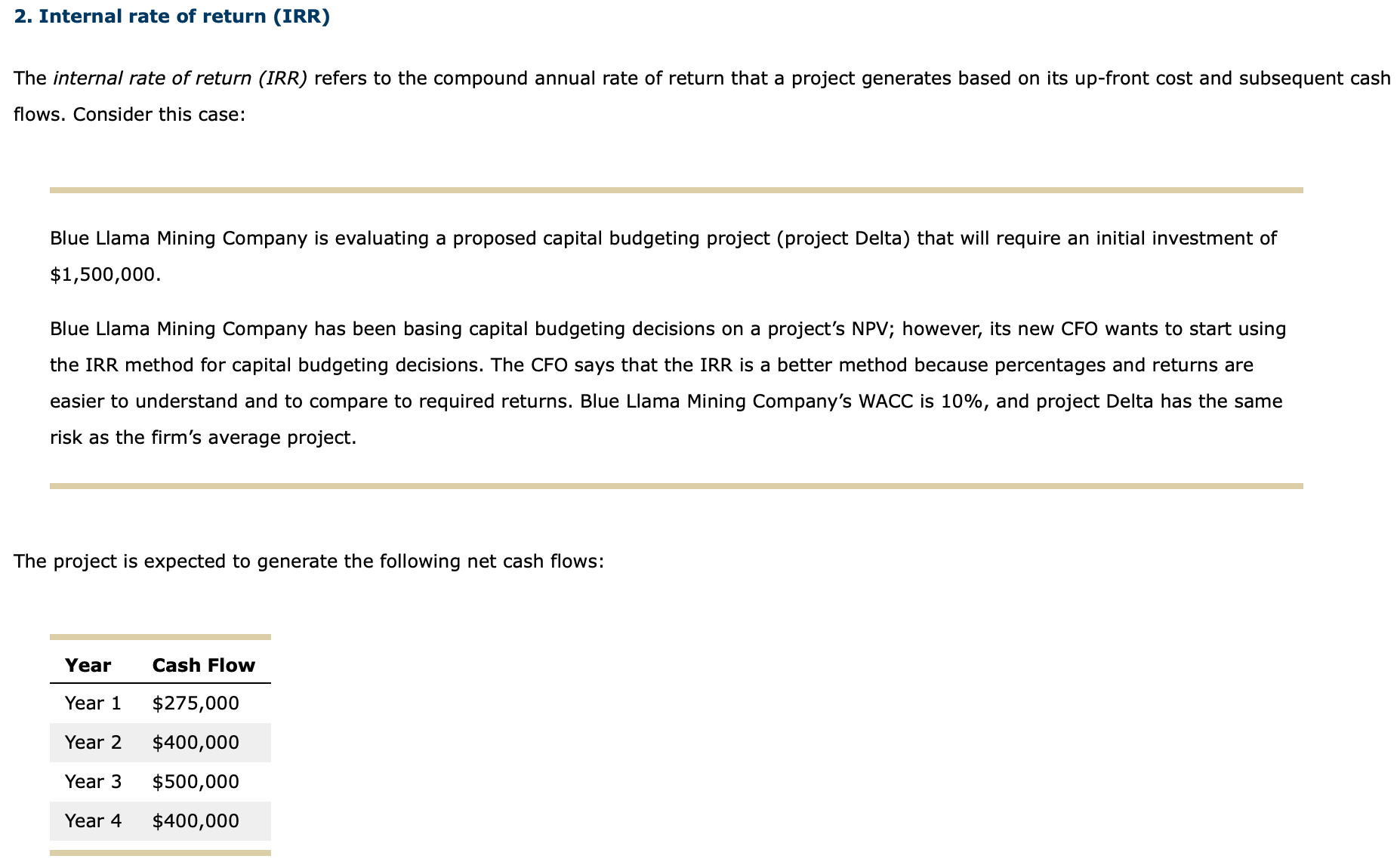

Solved 2. Internal rate of return (IRR) The internal rate of

The second project is to build a parking garage on a piece of land that the firm owns adjacent to the airport. The profitability index is greater than 1.0. Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer. The npv is greater than the discounted.

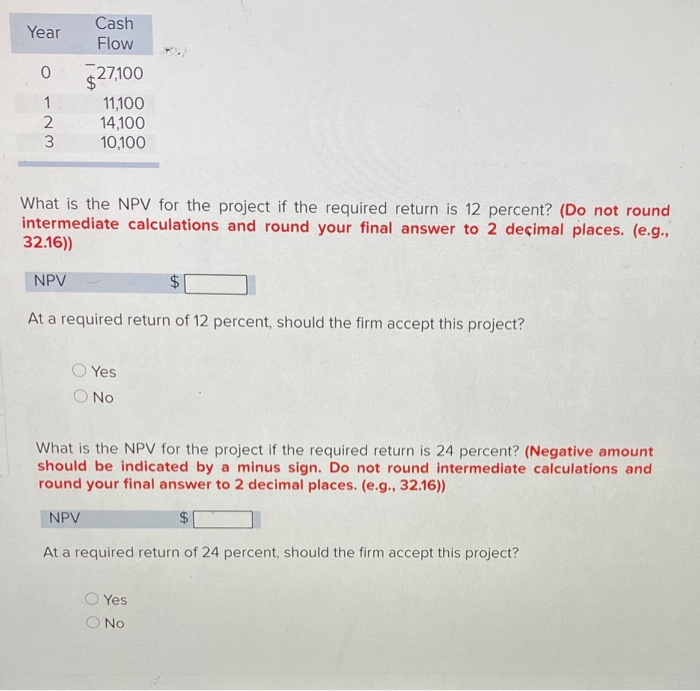

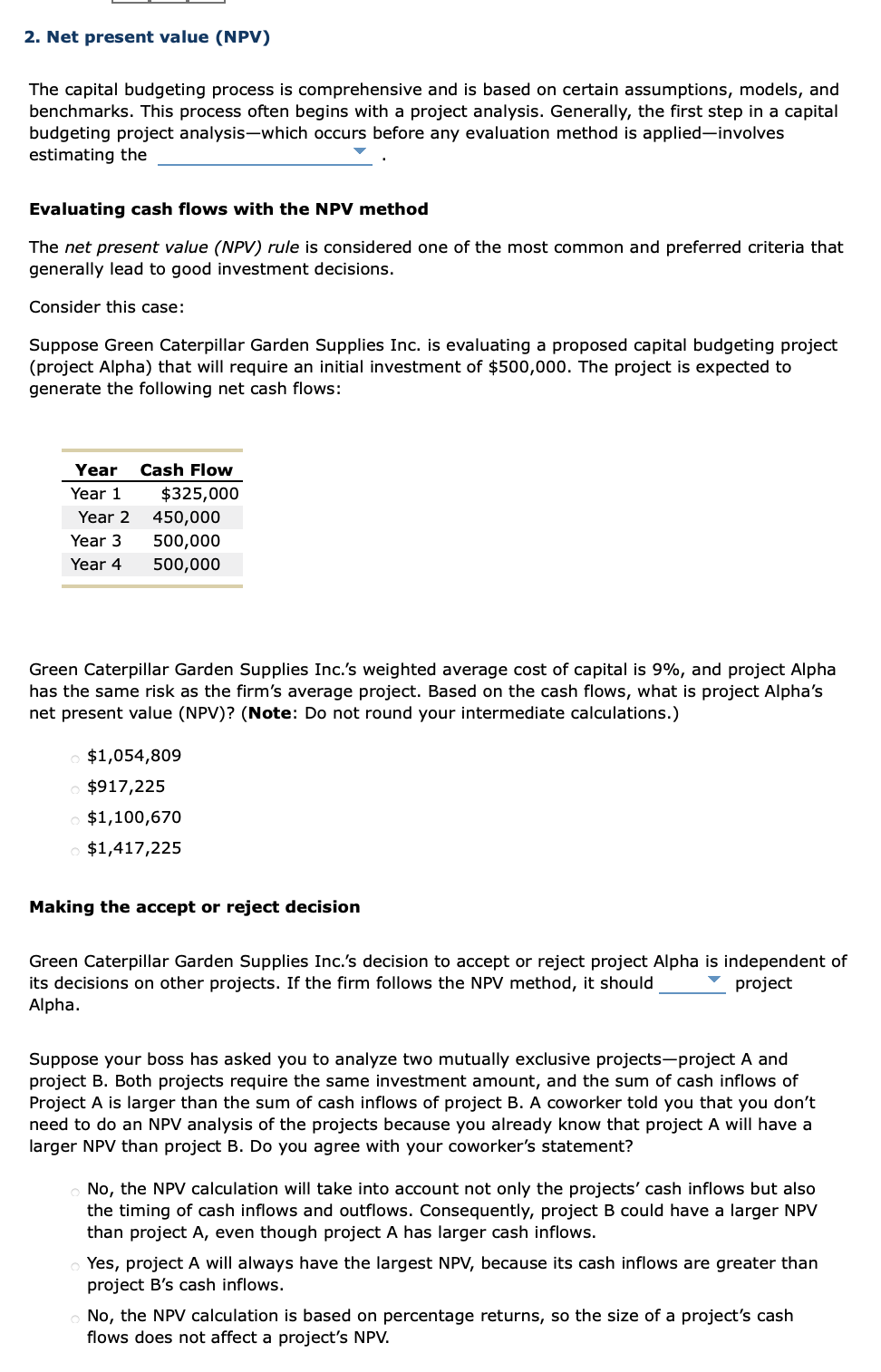

Solved 2. Net present value (NPV) The capital budgeting

the npv (net present value) is >0.c. A firm should accept independent projects if?a. the pi (profitability index) is <1.b. When the firm is considering independent projects, if the project's npv exceeds zero the firm should______the project. When the firm is considering independent projects, if the projects npv exceeds zero the firm should _____ the project.

When The Firm Is Considering Independent Projects, If The Projects Npv Exceeds Zero The Firm Should _____ The Project.

The npv is greater than the discounted payback. When the firm is considering independent projects, if the project's npv exceeds zero the firm should______the project. A firm should accept independent projects if the profitability index (pi) is greater than 1 or if the internal rate of return (irr) is greater than the. The second project is to build a parking garage on a piece of land that the firm owns adjacent to the airport.

When The Firm Is Considering.

The profitability index is greater than 1.0. The firm should accept independent projects if: A firm should accept independent projects if?a. the pi (profitability index) is <1.b.

The Npv (Net Present Value) Is >0.C.

When the firm is considering. Project a can be accepted because the payback period is 2.5 years but project b cannot be accepted because its payback period is longer.