941 Quickbooks

941 Quickbooks - We explain each form and how we support them in our quickbooks online payroll and quickbooks desktop payroll products. In this comprehensive guide, we will explore the various aspects of form 941 in quickbooks desktop and quickbooks online, including how. To get form 941 from quickbooks, start by verifying the accuracy of your company information within the payroll software,. Search for “payroll tax liability” and select the report for. For anyone who may be new to the game, form 941 is the employer’s quarterly federal tax return and employers use it to. To get your 941 form from quickbooks, follow these steps: Go to taxes, and click payroll tax. This comprehensive guide will walk you through the steps to easily generate and access form 941 using quickbooks online. Once done, you can follow these steps to view your 941 tax forms and file them manually:

Search for “payroll tax liability” and select the report for. To get your 941 form from quickbooks, follow these steps: Go to taxes, and click payroll tax. In this comprehensive guide, we will explore the various aspects of form 941 in quickbooks desktop and quickbooks online, including how. We explain each form and how we support them in our quickbooks online payroll and quickbooks desktop payroll products. Once done, you can follow these steps to view your 941 tax forms and file them manually: This comprehensive guide will walk you through the steps to easily generate and access form 941 using quickbooks online. For anyone who may be new to the game, form 941 is the employer’s quarterly federal tax return and employers use it to. To get form 941 from quickbooks, start by verifying the accuracy of your company information within the payroll software,.

Once done, you can follow these steps to view your 941 tax forms and file them manually: This comprehensive guide will walk you through the steps to easily generate and access form 941 using quickbooks online. Search for “payroll tax liability” and select the report for. We explain each form and how we support them in our quickbooks online payroll and quickbooks desktop payroll products. For anyone who may be new to the game, form 941 is the employer’s quarterly federal tax return and employers use it to. Go to taxes, and click payroll tax. In this comprehensive guide, we will explore the various aspects of form 941 in quickbooks desktop and quickbooks online, including how. To get your 941 form from quickbooks, follow these steps: To get form 941 from quickbooks, start by verifying the accuracy of your company information within the payroll software,.

PPT A StepbyStep Guide to Efiling Form 941 in QuickBooks Desktop

For anyone who may be new to the game, form 941 is the employer’s quarterly federal tax return and employers use it to. This comprehensive guide will walk you through the steps to easily generate and access form 941 using quickbooks online. Once done, you can follow these steps to view your 941 tax forms and file them manually: We.

Made Easy_ Form 941 QuickBooks Populates.pdf

For anyone who may be new to the game, form 941 is the employer’s quarterly federal tax return and employers use it to. We explain each form and how we support them in our quickbooks online payroll and quickbooks desktop payroll products. This comprehensive guide will walk you through the steps to easily generate and access form 941 using quickbooks.

PPT How can you Fix 941 forms in Quickbooks desktop? PowerPoint

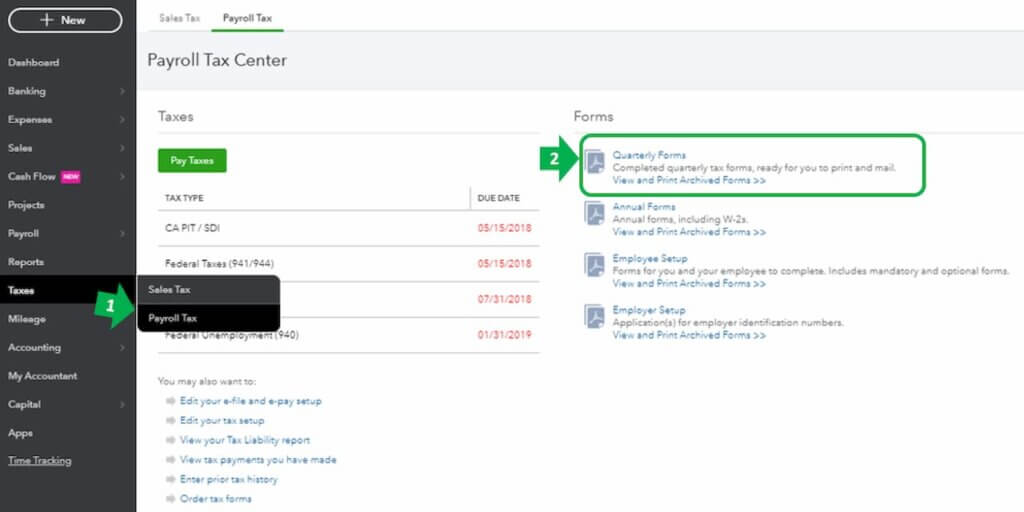

We explain each form and how we support them in our quickbooks online payroll and quickbooks desktop payroll products. To get form 941 from quickbooks, start by verifying the accuracy of your company information within the payroll software,. Once done, you can follow these steps to view your 941 tax forms and file them manually: Go to taxes, and click.

Made Easy_ Form 941 QuickBooks Populates.pdf

For anyone who may be new to the game, form 941 is the employer’s quarterly federal tax return and employers use it to. To get your 941 form from quickbooks, follow these steps: Search for “payroll tax liability” and select the report for. Once done, you can follow these steps to view your 941 tax forms and file them manually:.

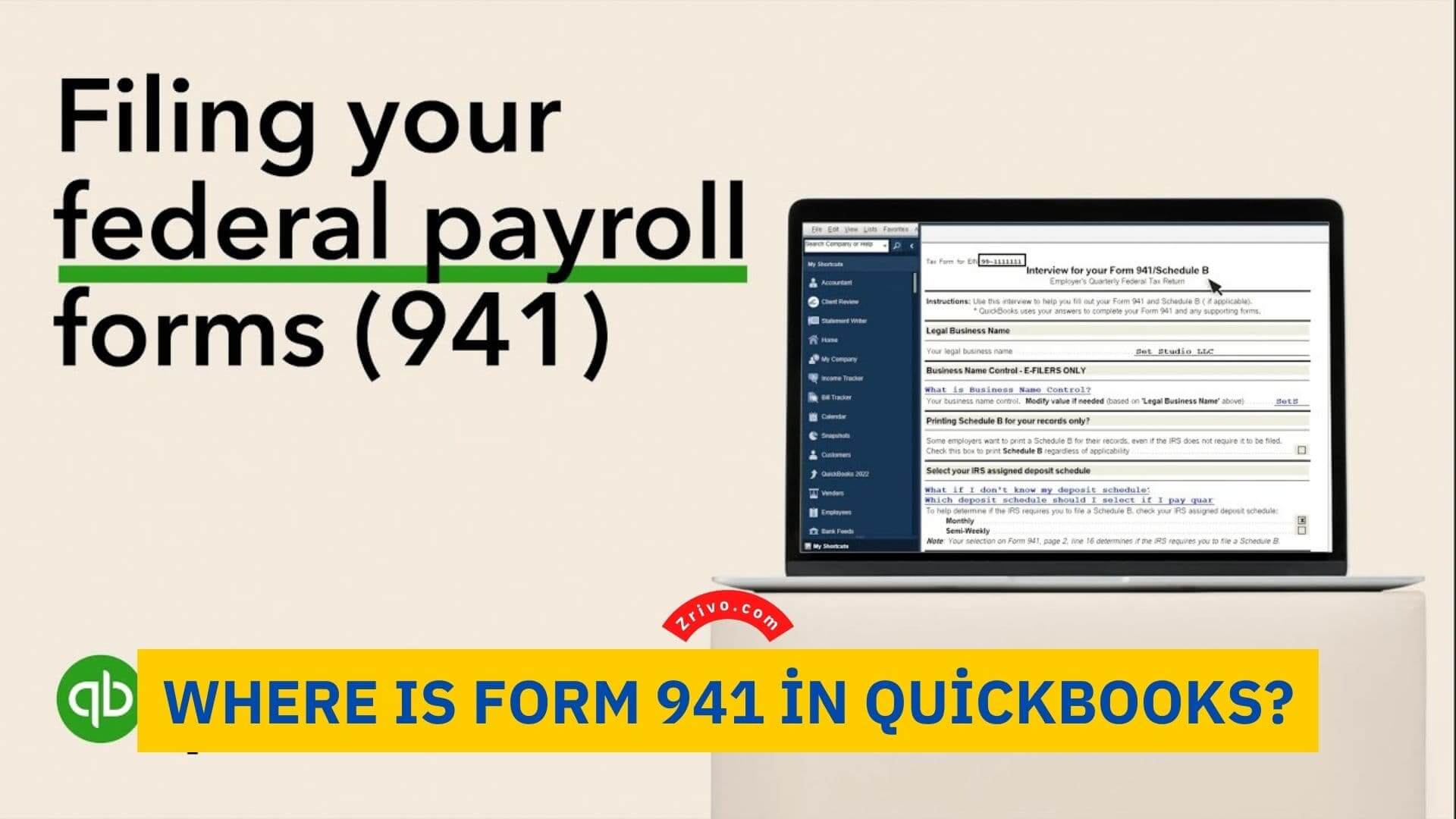

Where Is Form 941 In Quickbooks?

We explain each form and how we support them in our quickbooks online payroll and quickbooks desktop payroll products. Search for “payroll tax liability” and select the report for. Go to taxes, and click payroll tax. To get form 941 from quickbooks, start by verifying the accuracy of your company information within the payroll software,. For anyone who may be.

File a Corrected Federal Form 941 & 940 in QuickBooks Payroll

To get your 941 form from quickbooks, follow these steps: This comprehensive guide will walk you through the steps to easily generate and access form 941 using quickbooks online. Once done, you can follow these steps to view your 941 tax forms and file them manually: Search for “payroll tax liability” and select the report for. We explain each form.

Where Is Form 941 In Quickbooks?

To get your 941 form from quickbooks, follow these steps: For anyone who may be new to the game, form 941 is the employer’s quarterly federal tax return and employers use it to. Go to taxes, and click payroll tax. In this comprehensive guide, we will explore the various aspects of form 941 in quickbooks desktop and quickbooks online, including.

How to File Your Form 8974 and Form 941 QuickBooks

For anyone who may be new to the game, form 941 is the employer’s quarterly federal tax return and employers use it to. We explain each form and how we support them in our quickbooks online payroll and quickbooks desktop payroll products. Once done, you can follow these steps to view your 941 tax forms and file them manually: In.

How To View Old 941 In QuickBooks Online (Tutorial to Find Old 941 in

This comprehensive guide will walk you through the steps to easily generate and access form 941 using quickbooks online. To get form 941 from quickbooks, start by verifying the accuracy of your company information within the payroll software,. Search for “payroll tax liability” and select the report for. To get your 941 form from quickbooks, follow these steps: For anyone.

QuickBooks Form 941 File Your Federal Payroll Forms 2022

This comprehensive guide will walk you through the steps to easily generate and access form 941 using quickbooks online. We explain each form and how we support them in our quickbooks online payroll and quickbooks desktop payroll products. Go to taxes, and click payroll tax. Once done, you can follow these steps to view your 941 tax forms and file.

Once Done, You Can Follow These Steps To View Your 941 Tax Forms And File Them Manually:

We explain each form and how we support them in our quickbooks online payroll and quickbooks desktop payroll products. To get form 941 from quickbooks, start by verifying the accuracy of your company information within the payroll software,. For anyone who may be new to the game, form 941 is the employer’s quarterly federal tax return and employers use it to. Search for “payroll tax liability” and select the report for.

This Comprehensive Guide Will Walk You Through The Steps To Easily Generate And Access Form 941 Using Quickbooks Online.

In this comprehensive guide, we will explore the various aspects of form 941 in quickbooks desktop and quickbooks online, including how. To get your 941 form from quickbooks, follow these steps: Go to taxes, and click payroll tax.