1065 Form Due Date

1065 Form Due Date - Return of partnership income by the 15th day of the third month following the date. Generally, a domestic partnership must file form 1065 u.s. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top. You have 10 calendar days after. However, the general tax calendar, later, has important due dates for all businesses and. Return of partnership income, including recent updates, related forms and instructions on how to file. The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. Primarily, employers need to use this publication. Information about form 1065, u.s.

Information about form 1065, u.s. Primarily, employers need to use this publication. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top. However, the general tax calendar, later, has important due dates for all businesses and. Return of partnership income, including recent updates, related forms and instructions on how to file. Return of partnership income by the 15th day of the third month following the date. The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. You have 10 calendar days after. Generally, a domestic partnership must file form 1065 u.s.

Generally, a domestic partnership must file form 1065 u.s. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top. Return of partnership income, including recent updates, related forms and instructions on how to file. Return of partnership income by the 15th day of the third month following the date. Information about form 1065, u.s. Primarily, employers need to use this publication. The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. You have 10 calendar days after. However, the general tax calendar, later, has important due dates for all businesses and.

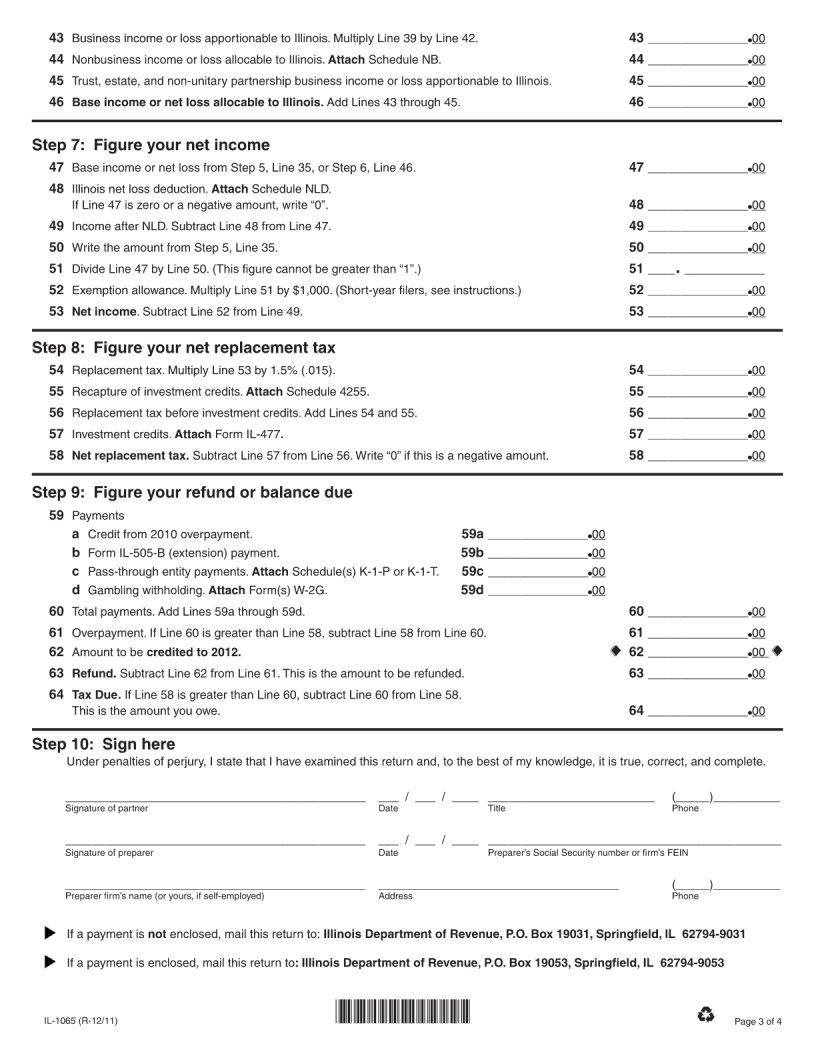

Form Il 1065 ≡ Fill Out Printable PDF Forms Online

Information about form 1065, u.s. The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top. However, the general tax calendar,.

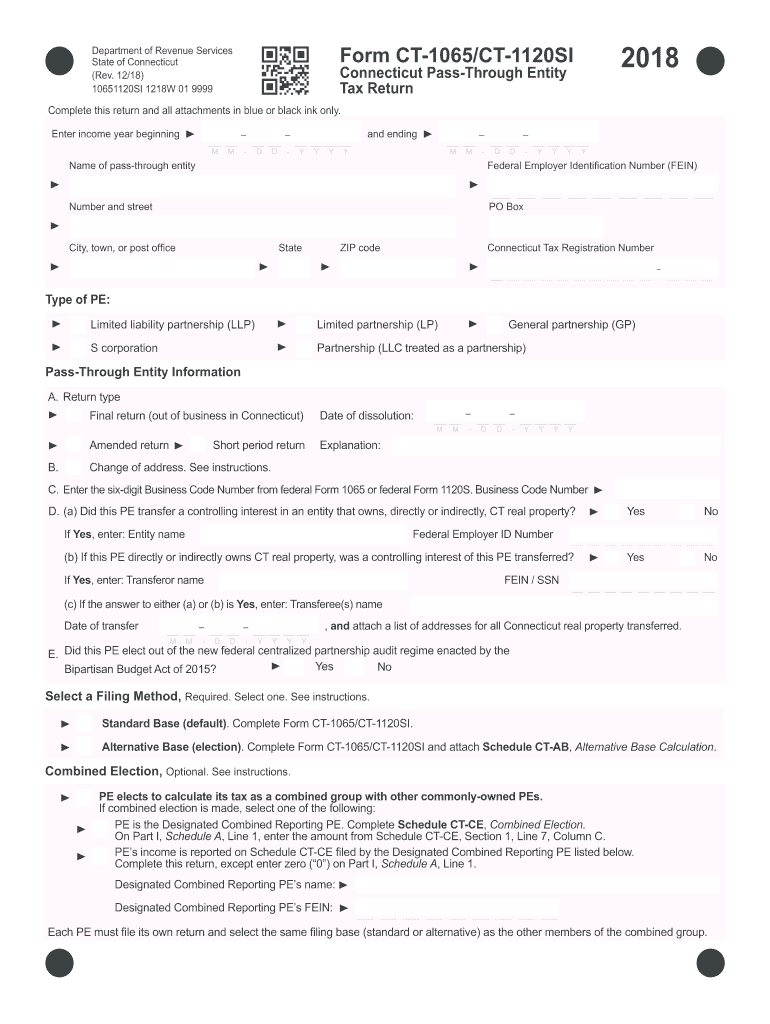

1065 Ct Due Date 20182024 Form Fill Out and Sign Printable PDF

Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top. Generally, a domestic partnership must file form 1065 u.s. You have 10 calendar days after. Primarily, employers need to use this publication. However, the general tax calendar, later, has important due dates.

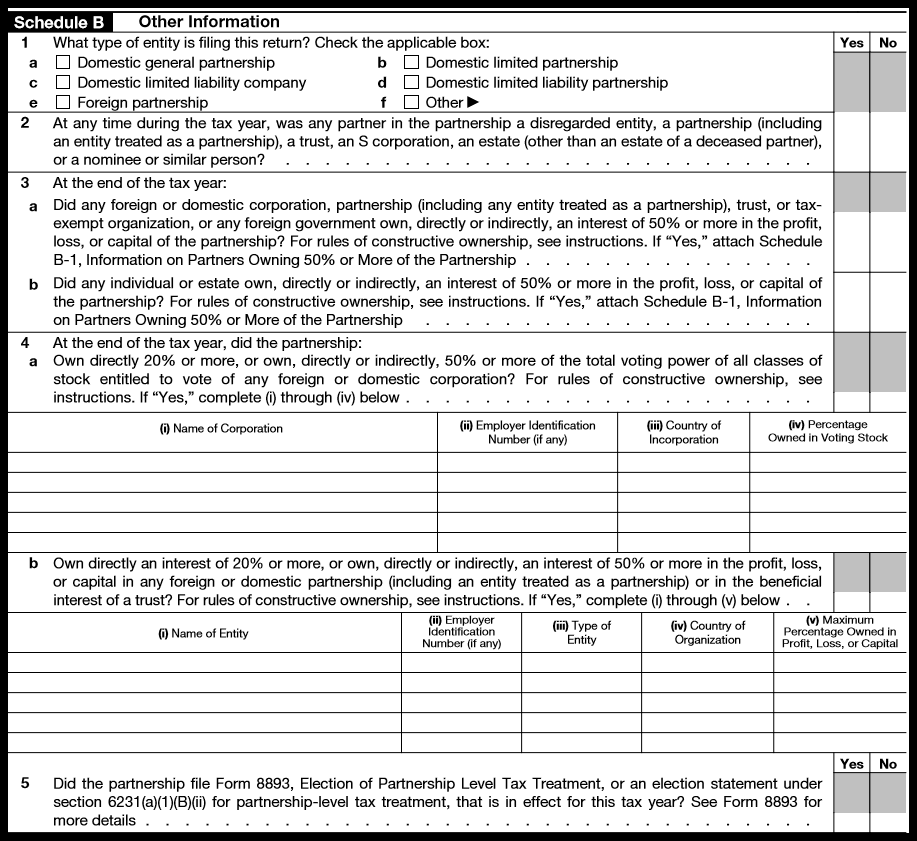

1065 JapaneseClass.jp

Primarily, employers need to use this publication. You have 10 calendar days after. Generally, a domestic partnership must file form 1065 u.s. Information about form 1065, u.s. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top.

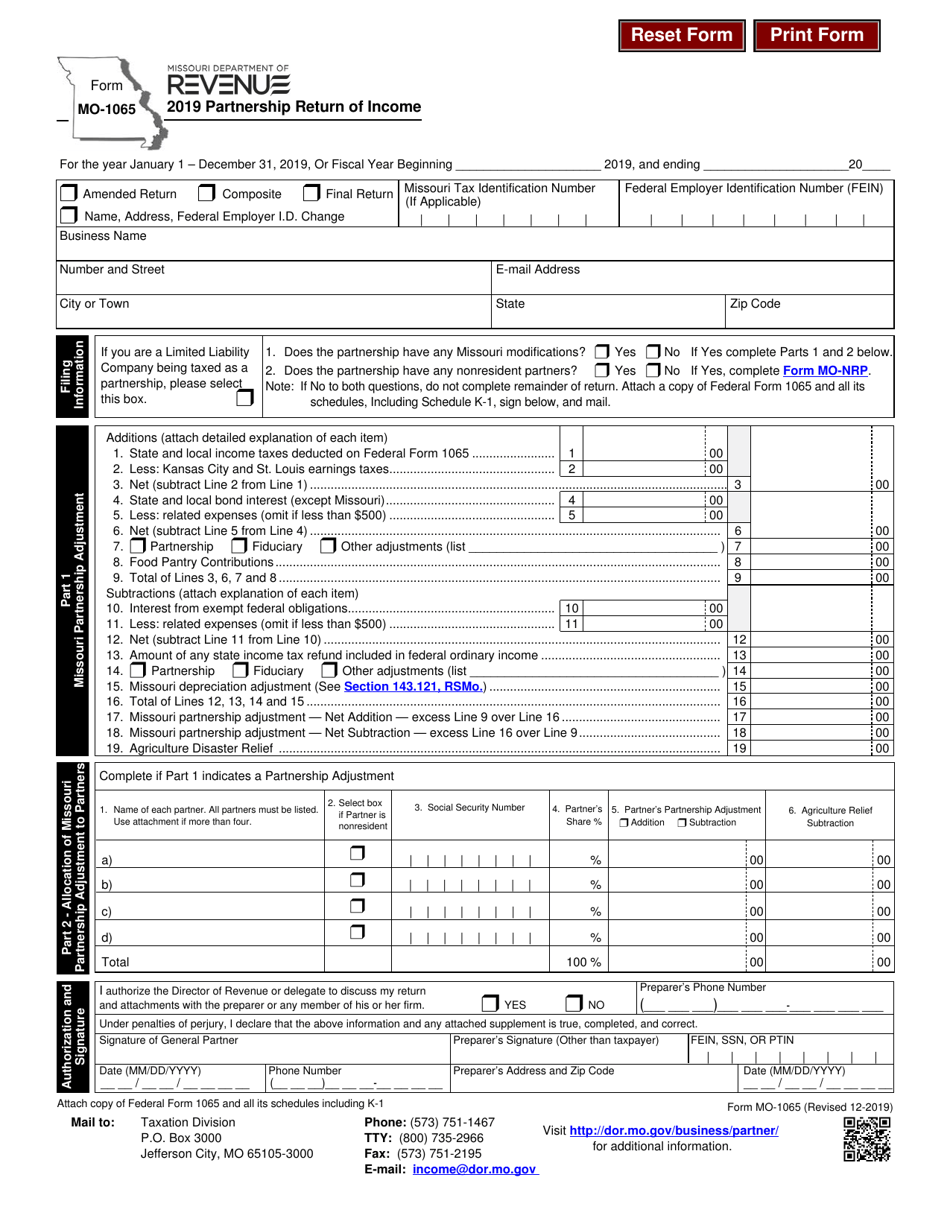

Form MO1065 2019 Fill Out, Sign Online and Download Fillable PDF

Generally, a domestic partnership must file form 1065 u.s. You have 10 calendar days after. Return of partnership income by the 15th day of the third month following the date. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top. The deadline.

1065 Form Generator ThePayStubs

Return of partnership income by the 15th day of the third month following the date. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top. Generally, a domestic partnership must file form 1065 u.s. However, the general tax calendar, later, has important.

Form 1065X Amended Return or Administrative Adjustment Request (2012

Primarily, employers need to use this publication. Generally, a domestic partnership must file form 1065 u.s. Information about form 1065, u.s. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top. The deadline for filing form 1065 is the 15th day of.

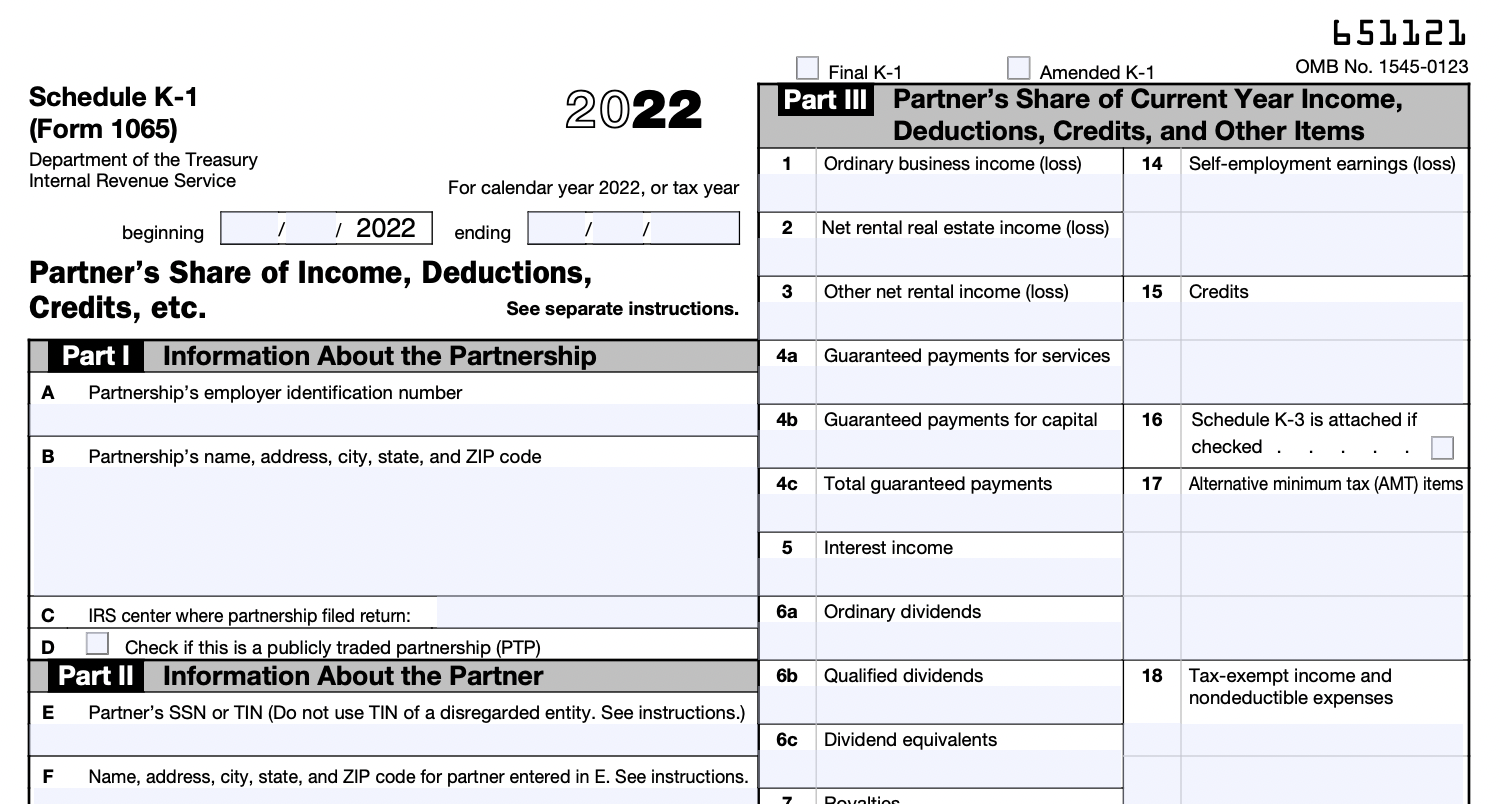

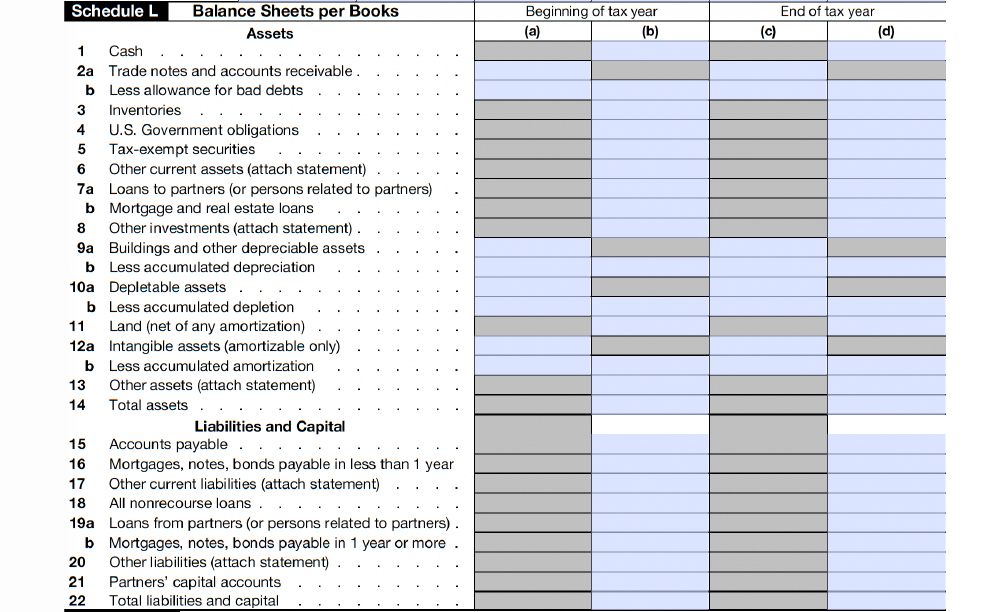

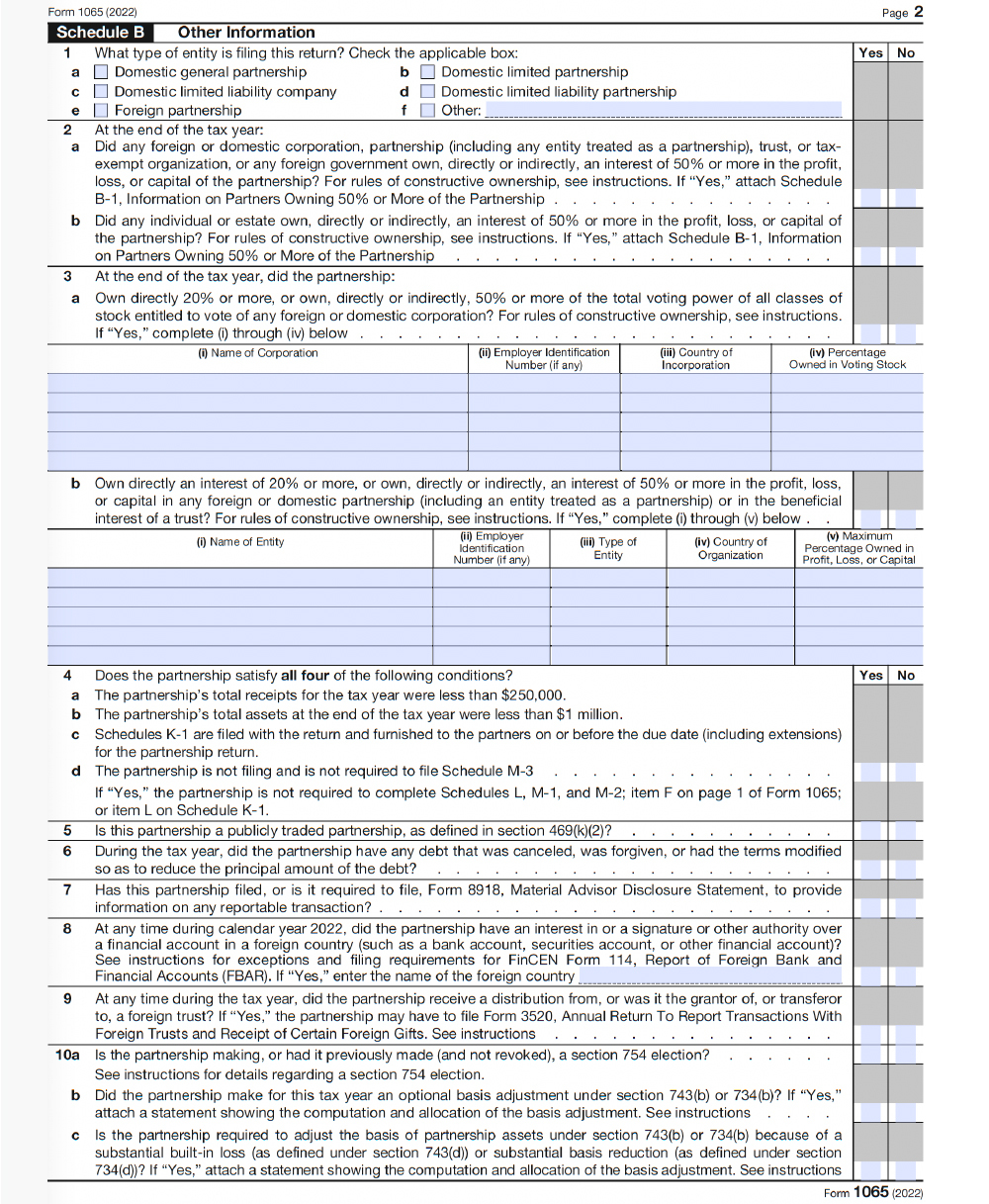

Form 1065 Instructions U.S. Return of Partnership

Information about form 1065, u.s. However, the general tax calendar, later, has important due dates for all businesses and. Return of partnership income, including recent updates, related forms and instructions on how to file. Generally, a domestic partnership must file form 1065 u.s. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following.

Form 1065 Extended Due Date 2024 Emili Inesita

However, the general tax calendar, later, has important due dates for all businesses and. You have 10 calendar days after. Primarily, employers need to use this publication. Generally, a domestic partnership must file form 1065 u.s. Information about form 1065, u.s.

What is Form 1065? TurboTax Tax Tips & Videos

Return of partnership income by the 15th day of the third month following the date. The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year. However, the general tax calendar, later, has important due dates for all businesses and. Generally, a domestic partnership must file form 1065 by.

How to File IRS Form 1065?

Information about form 1065, u.s. Primarily, employers need to use this publication. Return of partnership income by the 15th day of the third month following the date. You have 10 calendar days after. The deadline for filing form 1065 is the 15th day of the third month following the end of the partnership’s tax year.

Primarily, Employers Need To Use This Publication.

However, the general tax calendar, later, has important due dates for all businesses and. You have 10 calendar days after. Generally, a domestic partnership must file form 1065 u.s. Information about form 1065, u.s.

The Deadline For Filing Form 1065 Is The 15Th Day Of The Third Month Following The End Of The Partnership’s Tax Year.

Return of partnership income, including recent updates, related forms and instructions on how to file. Generally, a domestic partnership must file form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top. Return of partnership income by the 15th day of the third month following the date.